Sharing my personal experience and perspectives on these popular products and services written with my very own opinion and personal take. I’ll skip the product intro because you already have the basic knowledge about them and what they are used for, I think I can offer you a distinct review through personal stories that will be more helpful than general info.

Here are my stories with each of these financial products that are best in their market.

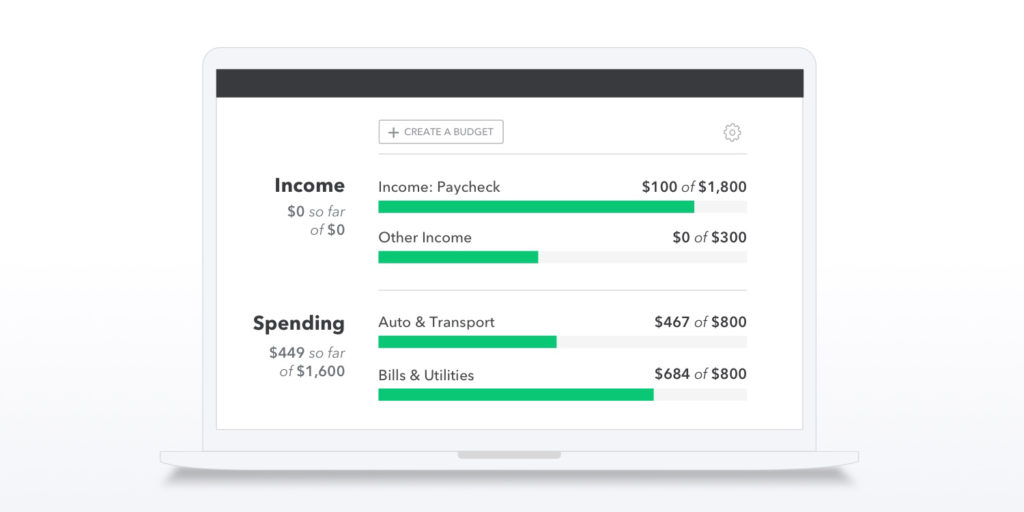

Best Budgeting App – Mint.com

Cost: FREE

I have been using Mint the last 12 years before the company was acquired by Intuit. By far, it’s been the best budgeting and expense tracking software / app.

Track towards budgets and goals

Personally, I had saved money towards goals for buying a home and building an emergency fund with the help of Mint by understanding my family spending and cashflow. It allows me to create budgets to track my spending every day with color coded progress bar, which helps me to stay in check controlling on our discretionary spending like shopping or dining out.

Report on saving trends and net worth

Mint is designed to auto categorize every transaction, while it may require my manual re-categorization at first for a few transactions every now and then, it’s becoming smart enough to do its job well over the years. Using the trend graphs, I have been able to watch and assess our net income and net worth for when the time comes to do our annual financial reviews.

Is Mint safe?

I think the most important question and concern that hold people back from using the service which connects to all the financial accounts a person has is this – is Mint safe? My short answer is yes. Mint is safe to use and you can read about how Mint, an Intuit company (the same maker of TurboTax and QuickBooks) address the security concerns here. But, if I may just add, we all should still apply best practices for good online habits in doing our part.

Best Financial Planning Software – Personal Capital

Cost: FREE (Unless you sign up for their advisor service)

I use Personal Capital mainly with the free program. While they offer financial advisor and investment management services, I am not considering those human services since I enjoy doing the research myself and DIY financial planning. With that said, the free tools are great, I recommend everyone to at least give it a try.

Track your net worth, cashflow, investment, retirement and more

With Personal Capital, you can see all your accounts in one place. It allows you to track your net worth, budget, cashflow, and portfolio. What’s really cool is the retirement planner and savings planner to help you track progress towards your retirement, savings and education goals. Also, the investment fee analyzer helps you to see how much fees would have incurred throughout your investment accounts. Through the investment checkup tool, you are able to compare your asset allocation with a target allocation based on your individual profile. There’s just so many benefits of using this free tool that makes it one of the best financial planning or wealth management software in the market.

Which is better: Mint or Personal Capital?

Mint and Personal Capital both have its own strength with focus on different features. Mint is great for tracking expenses and budgets while Personal Capital is great for overall wealth management with investing, retirement and saving planners that provide a more holistic view of your finances. I think it is better to use both of these financial applications than to choose either one.

Best Investment Brokerage – Fidelity

Cost: FREE ($0 commission trades; no minimums)

Low fees, low expense ratio

When it comes to investment brokerage firms, I highly recommend Fidelity. In most recent years, they have offered a lot of their services and funds at affordable cost, I guess to stay competitive especially with Vanguard gaining popularity in their low cost index funds. Fidelity now offers online trade with zero commission in stocks and ETFs. Even in terms of expense ratio, they offer index funds that have lower expense ratio than Vanguard and specific zero expense ratio type index funds such as FZROX, FZILX, and more.

Great platform with a ton of features and tools

Besides, Fidelity really does have a lot to offer. Their web application is easy to use, both desktop and mobile versions. You can create as many accounts under a profile including IRA, 401K, 529, etc. all requires no minimums. Researching stocks and mutual funds and ETFs on the website is straightforward and you can personalized with watch lists and notes to fit your needs. I also like that they are a company that constantly keep up with trends and stays innovative. They added dollar based investing just last week, I was excited as an existing customer to have this new feature to be able to trade in fractional shares.

Amazing customer service

But you know, the best part is their customer service. It’s usually a short wait when calling their customer service and on the other side of the line are always employees who are knowledgable and willing to go above and beyond to help. I have had only positive experiences when reaching out to Fidelity customer service.

Best Robo Advisor – Wealthfront

Cost: 0.25% per year for asset management

Offers diversification & maximizes returns

I see robo-advisors as a good mix of portfolio diversification. As a DIY investor, I don’t use financial advisor for making investing decisions. I do not enjoy getting sales calls on financial products. I do my own research and planning. That doesn’t mean I don’t expect a solid return on investment because I do. That’s why I use Wealthfront to help me maximize my investment. Over the past 5 years since I started investing through Wealthfront, the rate of return has been above 20%, which is far beyond the interest rate from any savings account.

Automatic rebalance, dividend reinvestment and tax loss harvest

While I pay a low annual fee of 0.25%, it is well worth the cost because other than the initial deposit where I set up my risk tolerance by answering a few questions, I do not spend additional time managing the portfolio. It’s automatically rebalanced, dividend reinvested and tax loss harvested for me. I have never received sales call nor upsell from Wealthfront.

Financial planning tools and actionable insights

The best part about Wealthfront that I really like is their retirement planning and financial planning tools and insights. It allows me to create savings goals, retirements goals, college education goals and then help me assess how I am on track towards each goal. With a projection calculation, it estimates the value at retirement what I will have compared to what I will need. And, it recommends the amount I should save monthly with allocation to which account in order to best reach my financial goals and retirement. I find the recommendations to be invaluable guidance for the little cost in fees I pay.

Money management made easy with technology

Wealthfront accounts can be managed on the web application as well as mobile app. Both have pleasant interfaces that are simple to use and easy to understand. I think financial planning should be made easy so more people have the financial literacy to master their money.

Referral: $5K Managed for FREE

If you are interested to invest through Wealthfront and would like to receive your first $5K managed for free, you can open an Automated Investing account here.

Best Micro Investing Platform – M1 Finance

Cost: FREE

Initial sign up process requires approval – can be improved

When I was looking into auto investing and fractional shares investing about a month ago, I signed up for M1 Finance. I tried out first creating a portfolio made up of different “pies” consisting of stocks and ETFs. Although I had a good first impression, I was disappointed with the delay on M1 Finance part in approving my registration after I had sent in my identification documents. It took them more than 3-5 days and during that 1 week pending duration, there was no update or email about my submission. I patiently waited and only after a week I received email about my account being approved.

Alternative to brokerage

Even though I deposited money to invest with them, I cancelled over the weekend. Coincidently, Fidelity just rolled out their dollar based investing feature, and I decided to stick with Fidelity. While I am not currently investing through them, I consider them a good option especially for fractional shares investing based on my experience as short as it may seem. Investing for free is appealing because you can maximize your money to be fully invested.

Build custom and diversified portfolio with fractional shares

I like that I can create custom “pie” with stocks and funds, and diversified with the more pies I add to my portfolio. If you are interested in growth stocks like Apple, Microsoft, Tesla, Amazon and want to start with little investment amount in the beginning, M1 Finance lets you buy these equity stocks in fractional shares as little as $100 for the first deposit with no minimum limit on subsequent investments.

Summary

Hope my candid reviews are helpful. If you haven’t used any of these products and are wondering if they are any good, I suggest you to give them a try. You can always discontinue if they no longer work well for you. I recommend them just because I personally have had positive experience and find them to be the best at what they do in their market.

So, what personal finance products do you love and would recommend?