5 Best Of Personal Finance Products & Why I Love Them

Sharing my personal experience and perspectives on these popular products and services written with my very own opinion and personal take. I’ll skip the product intro because you already have the basic knowledge about them and what they are used for, I think I can offer you a distinct review through personal stories that will be more helpful than general info.

Here are my stories with each of these financial products that are best in their market.

Best Budgeting App – Mint.com

Cost: FREE

I have been using Mint the last 12 years before the company was acquired by Intuit. By far, it’s been the best budgeting and expense tracking software / app.

Track towards budgets and goals

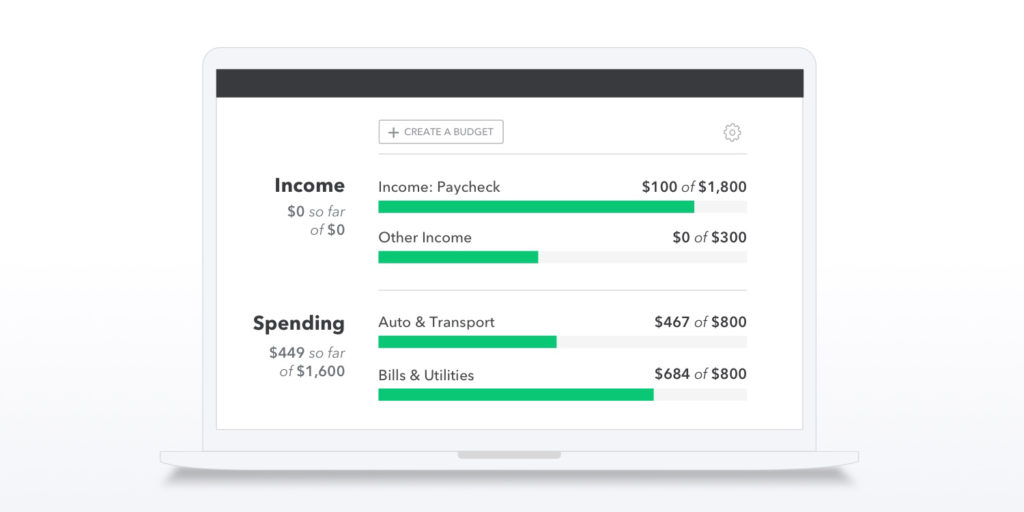

Personally, I had saved money towards goals for buying a home and building an emergency fund with the help of Mint by understanding my family spending and cashflow. It allows me to create budgets to track my spending every day with color coded progress bar, which helps me to stay in check controlling on our discretionary spending like shopping or dining out.

Report on saving trends and net worth

Mint is designed to auto categorize every transaction, while it may require my manual re-categorization at first for a few transactions every now and then, it’s becoming smart enough to do its job well over the years. Using the trend graphs, I have been able to watch and assess our net income and net worth for when the time comes to do our annual financial reviews.

Is Mint safe?

I think the most important question and concern that hold people back from using the service which connects to all the financial accounts a person has is this – is Mint safe? My short answer is yes. Mint is safe to use and you can read about how Mint, an Intuit company (the same maker of TurboTax and QuickBooks) address the security concerns here. But, if I may just add, we all should still apply best practices for good online habits in doing our part.

Best Financial Planning Software – Personal Capital

Cost: FREE (Unless you sign up for their advisor service)

I use Personal Capital mainly with the free program. While they offer financial advisor and investment management services, I am not considering those human services since I enjoy doing the research myself and DIY financial planning. With that said, the free tools are great, I recommend everyone to at least give it a try.

Track your net worth, cashflow, investment, retirement and more

With Personal Capital, you can see all your accounts in one place. It allows you to track your net worth, budget, cashflow, and portfolio. What’s really cool is the retirement planner and savings planner to help you track progress towards your retirement, savings and education goals. Also, the investment fee analyzer helps you to see how much fees would have incurred throughout your investment accounts. Through the investment checkup tool, you are able to compare your asset allocation with a target allocation based on your individual profile.

Read More »